Each month, the Federal Reserve Bank of New York publishes monthly economic snapshots. To make this report accessible to a wider audience, we’ve identified the three most important takeaways from the FED’s latest economic snapshot.

1. Recession depends on growth figures in Q2

A recession starts when an economy exhibits two consecutive quarters of negative GDP growth. Because U.S. GDP shrank by -1.5% in Q1 2022 (January to March), a lot rests on the Q2 figure (April to June) which should be released on July 28th.

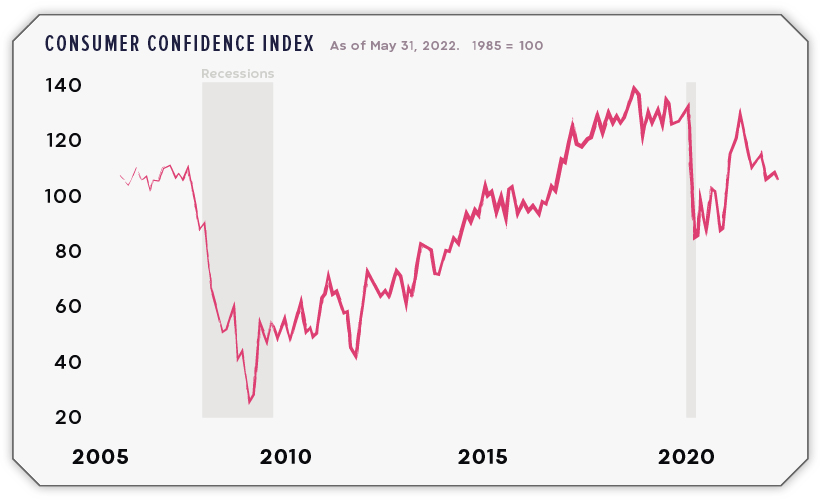

Economists predict that U.S. GDP will grow by +2.1% in Q2. This would mark a decisive reversal from Q1, and put an end to recessionary fears for the time being. However inflation is still the top financial concern for Americans, dampening consumer confidence. Shown below, the consumer confidence index reflects the public’s short-term outlook for income, business, and labor conditions.

Falling consumer confidence suggests that more people will delay big purchases such as cars, major appliances, and vacations.

2. The housing boom might be over

Housing markets have been riding high since the beginning of the COVID-19 pandemic, but this run is likely coming to an end.

Here’s a summary of what’s happened since 2020:

- Lockdowns in early 2020 created lots of pent-up demand for homes

- Greater household savings and record-low mortgage rates pushed demand even further

- Supply chain disruptions greatly increased the cost of materials like lumber

- Construction of new homes couldn’t keep up, and housing supply fell to historic lows

Today, home prices are at record highs and the cost of borrowing is rapidly rising. For evidence, look no further than the 30-year fixed mortgage rate, which has doubled to more than 6% since the beginning of 2022.

Given these developments, the drop in the number of home sales could be a sign that many Americans are being priced out of the market.

3. Groceries won’t get any cheaper in the meantime

Inflation has been a hot topic this year, especially with gas prices reaching $5 a gallon. But there’s one category of goods that’s perhaps even more alarming: food.

The following table includes food inflation over the past three years, as the percent change over the past 12 months.

From this data, we can see that food inflation really picked up speed in April 2020, jumping to +3.5% from +1.9% in the previous month. This was due to supply chain disruptions and a sudden rebound in global demand.

Fast forward to today, and food inflation is running rampant at 10.1%. A contributing factor is the impending fertilizer shortage, which stems from the Ukraine war. As it turns out, Russia is not only a massive exporter of oil, but wheat and fertilizer as well.

Story attributed to Visual Capitalist.