The food delivery app market in the U.S. is shifting from an oligopoly, where market control was shared amongst four companies, to more of a duopoly setting.

According to McKinsey & Company, two major players—DoorDash and Uber Eats—control close to 80% of the food delivery market as of 2021.

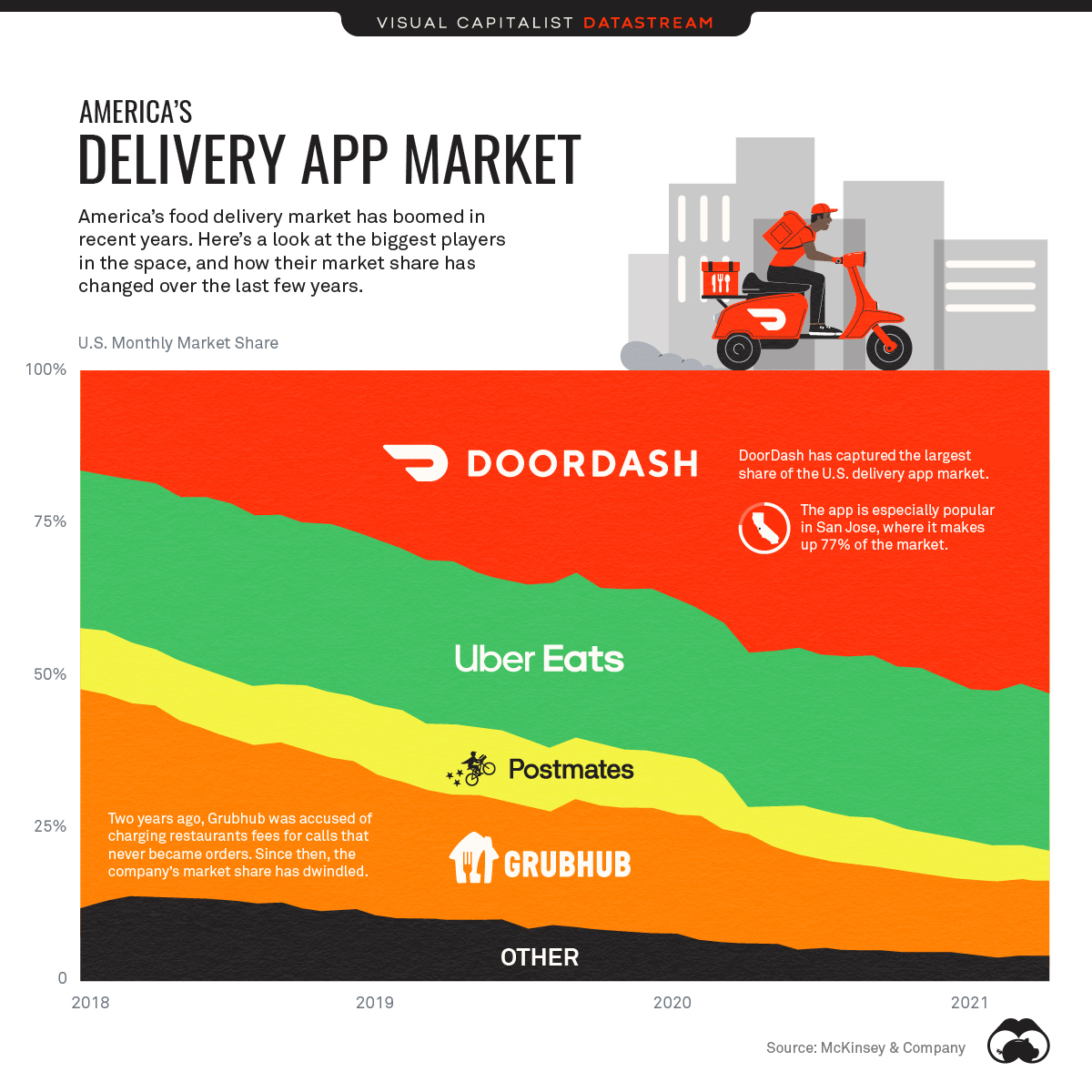

Here’s how the overall food delivery app market has shifted since 2018:

The Most Popular Food Delivery App in the U.S.

The COVID-19 pandemic has helped accelerate DoorDash’s rapid growth and market dominance. The food delivery company increased its market share from under 20% in 2018 to 53% in 2021.

As the world stayed indoors to weather the pandemic, the entire U.S. delivery app market grew 48.3% within the first couple months of 2020. And over the course of the year, DoorDash’s individual share of the market grew by about 12.5 percentage points, helping the company’s annual revenue to balloon from $0.85 billion in 2019 to $2.88 billion in 2020.

Related: Gas prices at all-time high

While an easy-to-use interface was a critical component of this success, many market analysts attribute DoorDash’s pandemic boom to a combination of superior customer data and brand positioning as an ally to struggling restaurants during the pandemic.

This success culminated in a widely-discussed IPO in December 2020, where in its first day of trading, DoorDash stock prices soared 86% to $190 per share.

DoorDash and Uber Eats Crowd Out the Competition

Throughout DoorDash’s growth, Uber Eats has remained their biggest competitor and maintained roughly 25% of the U.S. delivery app market since 2018.

These achievements have come at the expense of Postmates, Grubhub, and other smaller players, which have seen their market shares decrease substantially. It is worth noting that both Postmates and Grubhub have still seen increases in their annual revenue, in part due to the increasing size of the overall market.

That said, lesser-known platforms such as Delivery.com and ChowNow are decreasing in significance to the industry. As the delivery app market matures, control is increasingly consolidating in the hands of a smaller number of companies.