Soaring inflation, the war in Ukraine, and strengthening economies are spurring interest rate increases around the world. At the same time, central banks are unwinding record monetary stimulus from COVID-19.

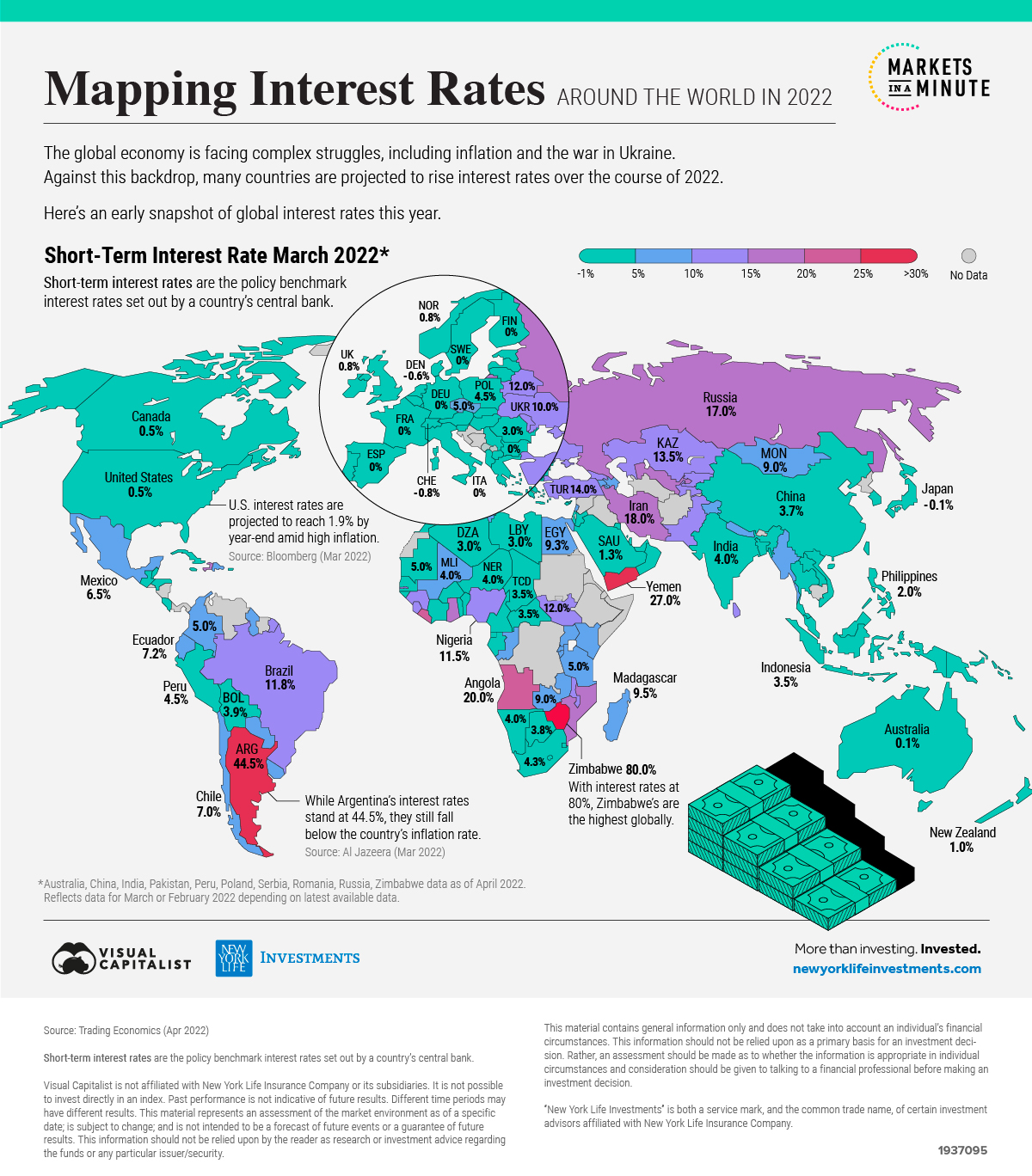

In this Markets in a Minute from New York Life Investments, we show interest rates by country in 2022. Interest rates are based on short-term benchmark policy rates set out by central banks.

Interest Rates Around the World in 2022

While the vast majority of countries saw a decline in interest rates over recent years, this trend is reversing for many in 2022.

After hovering at 0.0%, the U.S. increased its short-term interest rate to 0.5%. Experts project up to seven interest rate hikes this year, with interest rates rising as high as 1.9% by year-end.

For many countries in Europe, interest rates climbed out of negative territory for the first time since 2014. They now sit at 0.0% across the European Union.

In Latin America, several central banks are taking a hawkish stance as oil price shocks are causing inflation to accelerate.

Related: Visualizing the Distribution of Household Wealth, By Country

Mexico raised its benchmark interest rate to 6.5% in March in response to inflation hitting 20-year highs. Even before the war in Ukraine, global factors such as rising oil and import prices were already having a greater impact on Latin American countries than advanced economies.

Unlike the U.S. and most countries located in Europe and Latin America, China is anticipated to potentially lower its interest rates.

A renewed COVID-19 wave has slowed growth, with the government requiring countless factories to close in order to combat the spread of the Omicron variant. Disruptions have cascaded across supply chains—from electric vehicles to iPhones— leaving goods in shorter supply. China is responsible for roughly one-third of global manufacturing.

High-water Mark

Which countries have the highest interest rates in 2022?

At an eye-watering 80%, Zimbabwe has the highest interest rate of any country.

In early April, the central bank raised rates by 20 percentage points to combat a 73% inflation rate. Small businesses, teachers, and analysts have been urging the government to adopt the U.S. dollar to boost economic and investor confidence amid currency woes.

With an interest rate of 44.5%, Argentina has the second-highest rate. To get closer to reaching the requirements for rescheduling its $40 billion loan to the International Monetary Fund (IMF), the central bank raised interest rates for the second time this year. The IMF requires having interest rates above the rate of inflation. As of February, Argentina’s inflation exceeded 50%.

Meanwhile, oil-rich countries such as Angola (20%), Iran (18%), and Russia (17%) all made it into the top 10 for highest rates globally.

Treading Water

What is the outlook for 2022 and beyond?

In the short term, experts believe interest rates will likely rise to fight inflation. They could also play a role in slower economic growth, especially if raised too quickly. Recently, the World Bank revised global growth to 3.2% due to the war in Ukraine and rising food and energy prices—about a percentage point lower than its previous forecast of 4.1%.

Related: How the Mobile Phone Market Has Evolved Over 30 Years

The longer-term view may look different.

Structural factors, such as an aging population, will likely lead to an increase in savings rates for retirement. In theory, higher savings rates increases the total supply of funds. By 2100, people over 50 are projected to rise from 25% to 40% of the global population.

The end of ultra-low interest rates may be over for now, but broader factors, including growing global debt—which stands at 355% of the world’s GDP—suggests it may be a short to medium-term adjustment.