As the invasion of Ukraine wears on, European countries are scrambling to find alternatives to Russian fossil fuels. However many Russian fossil fuel shipments are still being transported as Russia earned €93 billion in revenue from fossil fuel exports in the first 100 days of the invasion. However, an estimated 93% of Russian oil sales to the EU are due to be eliminated by the end of the year, and many countries have seen their imports of Russian gas plummet.

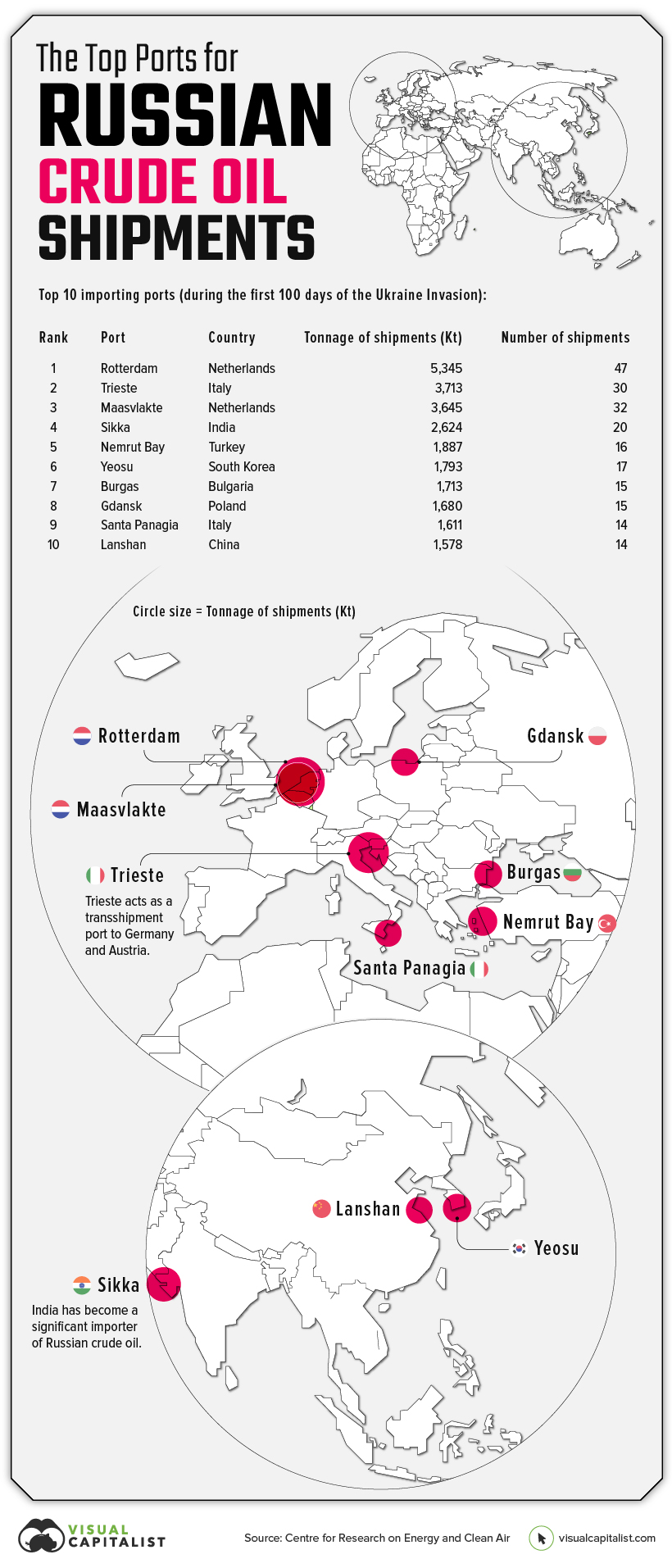

While the bulk of fossil fuels travel through Europe via pipelines, there are still a number marine shipments moving between ports. The maps below, using data from MarineTraffic.com and Datalastic, compiled by the Centre for Research on Energy and Clean Air (CREA), are a look at Russia’s fossil fuel shipments during the first 100 days of the invasion.

The main Russian fossil fuel shipments

Much of Russia’s marine shipments of crude oil went to the Netherlands and Italy, but crude was also shipped as far away as India and South Korea.

India became a significant importer of Russian crude oil, buying 18% of the country’s exports (up from just 1%). From a big picture perspective, India and China now account for about half of Russia’s marine-based oil exports.

Related: Explainer: What Key Factors Influence Gas Prices?

It’s important to note that a broad mix of companies were involved in shipping this oil, with some of the companies tapering their trade activity with Russia over time. Even as shipments begin to shift away from Europe though, European tankers are still doing the majority of the shipping.

Russia’s Liquefied Natural Gas Shipments

Unlike the gas that flows along the many pipeline routes traversing Europe, liquefied natural gas (LNG) is cooled down to a liquid form for ease and safety of transport by sea. Below, we can see that shipments went to a variety of destinations in Europe and Asia.

Fluxys terminals in France and Belgium stand out as the main destinations for Russian LNG deliveries.

Russia’s Oil Product Shipments

For crude oil tankers and LNG tankers, the type of cargo is known. For this dataset, CREA assumed that oil products tankers and oil/chemical tankers were carrying oil products.

Huge ports in Rotterdam and Antwerp, which house major refineries, were the destination for many of these oil products. Some shipments also went to destinations around the Mediterranean as well.

All of the top ports in this category were located within the vicinity of Europe.

Russia’s Coal Shipments

Finally, we look at marine-based coal shipments from Russia. For this category, CREA identified 25 “coal export terminals” within Russian ports. These are specific port locations that are associated with loading coal, so when a vessel takes on cargo at one of these locations, it is assumed that the shipment is a coal shipment.

The European Union has proposed a Russian coal ban that is expected to take effect in August. While this may seem like a slow reaction, it’s one example of how the invasion of Ukraine is throwing large-scale, complex supply chains into disarray.

With such a heavy reliance on Russian fossil fuels, the EU will be have a busy year trying to secure substitute fuels – particularly if the conflict in Ukraine continues to drag on.